Card Payments Schedules

Paying by Instalments

If your service is offering your customers the opportunity to pay by instalments, this will need to be enabled in the System Configuration menu. Under the Finance tab you can enable whether you offer instalment plans, and the frequency available. For example, you can offer:

- Payment per Term or Monthly

- Payment Per Month

- Payment Per Term

- None

You can also set the number of days before the end of the academic year that you need the final instalment by.

Important: It is worth noting not all payment providers support recurring payments, this is something you will need to check with them. Paying in instalments is only available for systems set up to use the Offer Process.

The setup of the instalment will depend on the activity pupils are going to do. These are discussed further below.

Tuition, Hire & Group Membership - If you have enabled paying by instalments in the System Configuration, Parents/Guardians can indicate how they would like to pay when accepting their offer.

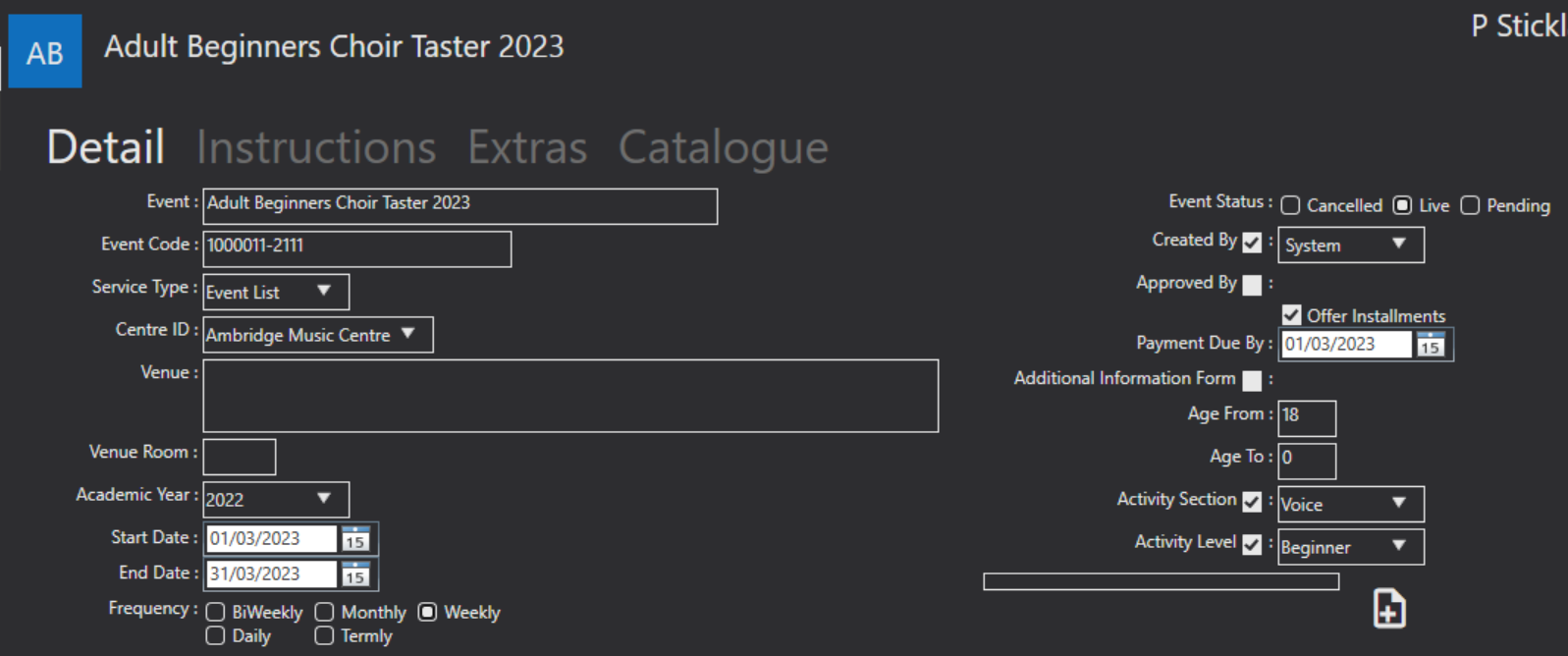

Events - If you have enabled paying by instalments in the System Configuration, and you would like to offer instalments for an event you will need to state this in the event set-up. Open the event and click on the Detail tab followed by the Edit icon.

On the right hand side of the screen you will see a tick box for Offer Installments. Tick this if you wish to enable paying by instalments for this event. this on. You will also find a Payment Due By field. Enter the date you need the final instalment paid by. Xperios will work out how many instalments are available to the customer which they can select when accepting their offer.

Auditions / Exams - It is not possible to offer instalment plans for auditions or exams. Customer will need to pay a one off fee upon application.

Card Payment Schedules

Depending on the options you've selected, a range of instalments are offered. The system will create a Payment Schedule based on the number of instalments selected. The initial payment will be classed as the first instalment. In all cases the final instalment is dated before the paid by date.

An automated process within Xperios manages the process of collecting the scheduled payments. First, it sends out an Intention to take Payment email three dates before the first scheduled date. This can be a simple note that the payment is to be taken. If the system finds the associated card has expired, it will send out an email asking the customer to make a payment via the portal and to update their card details.

On the scheduled date, the system will attempt to take the payment.

Note: it will only do this if the intention email was sent in time. It is possible for the customer to change the date of their scheduled payments. This could bring the date forwards so that not enough time has elapsed between sending the email and the due date. In this case, the payment will be deferred for one or two days.

Assuming the payment is successful, an email stating the progress of the payment is sent out to the customer and a receipt is posted to the customer’s account.

If the attempt to take the payment at the start of the month failed, the customer will have received a failed payment email. The email states that another attempt will be made in five days’ time unless they go online and make a manual payment.

If the second attempt fails, the customer will get another failed attempt email stating that a further attempt will be made in five days. This process repeats four times after which, if the payment was not successful, the system will add the debtor to the List Failed Schedule Card Transactions report accessible from the Business Management menu. Admin staff will need to regularly manually review and contact these debtors to ascertain if they are continuing with their activity and if when payment can be made.

Three days before the next scheduled payment (For example, the customer’s March payment) they will get an email notifying them that the payment will be taken. This gives the customer the opportunity to ensure they have the required funds and can meet the scheduled payment. If the system recognises that the card on file has expired the email will state this and inform the customer to go online and pay that month’s instalment manually. In doing so, the XPERIOS system can update the payer’s card details ready for the next scheduled payment in March.

Note: when a payment fails the system will reschedule the next attempt but does not reschedule the whole debt.

Example: A customer is scheduled to pay £50 on the 2nd of each month. If the March 2nd payment fails it will be rescheduled to be taken on the 7th. If that payment fails it will be rescheduled for the 12th. If that fails, it is finally rescheduled for the 19th. If it is successful, then payments will resume as they normally would (next month’s payment would be due on the agreed date of the 2nd and not one month from the date of successful payment). In such an extreme case the customer will only be twelve to fourteen days between one payment and the next.